Content

e peso breaks can be an online financing podium that enables you to borrow money small quantities of income. You should use the finance have an sudden expenses or connection the difference involving the paychecks. Its intended for Filipino inhabitants.

Any request is provided for free to drag and start has a straightforward port. Nonetheless it offers preferential charges and versatile payment terminology.

PinoyLend-Insta Peso Money Improve

This can be a totally free-to-use fiscal software that lets you borrow cash on-line. You should use the financing to protecting abrupt bills or match up any to the point-expression fiscal likes. Their snap-to-use vent and initiate secure encrypted sheild benefit you really feel sure if a info is risk-free. You can even select the amount you’ll want to borrow and how long an individual pay off it can.

Another new aspect is his or her paperless method. The particular helps you to save time and resources. In addition, this treatment is actually automatic, so that you can signup the financing any time for the day. This will make the task rapidly and start portable, designed for energetic a person. It’s also great for people that by no means be given a charge card or even bank accounts.

Unlike some other on-line capital devices, PinoyLend-Insta Peso Money Advance doesn’t involve a new costs as well as expenses to borrow. It’s signed up with the Stocks and start Trade Commission (SEC) as an listed economic business. This gives one to foundation the organization in order to avoid frauds.

If you wish to qualify for a cashalo legit PinoyLend-Insta Peso improve, you have to be between your five and initiate 65 yrs.old, take a bank-account inside the Indonesia, and possess a phone. It is not hard, quickly, and initiate safe, and you will take your money inside of fracture. In addition, any application will come each day.

MadaLoan take loan pera peso.

Madaliloan snap lend pera peso is a monetary application that produces it easier for someone to borrow income. It will makes use of portable online security and initiate main-details investigation revolution to really make it much easier to acquire a person to try to get funding and possess popularity quickly. It assists to increased Filipinos becoming free of fiscal issues so as to adhere to the woman’s needs and commence complete their demands.

The top options that come with the actual application can it be is totally liberated to don. Members may record on the internet by providing the army-naturally Recognition and also a portable volume. After that, they can pick a progress flow with a few,000 if you wish to 10,000 Philippine pesos with adaptable charging vocab and commence low interest fees. In addition, they can also acquire credit after as little as five min’s!

Your progress software packages are regarding mature Filipinos who have dependable profits all of which go with the woman’s transaction commitment. Doing this, that they buy your cash they’ve without the economic settlement or credit card bills. The company features a devoted to customer service part to offer assistance due to the members.

An excellent component of the improve software program is who’s supports teams of payment possibilities, such as m-finances and initiate supermarkets. Additionally it is safe off their, which has a numbers of facts security treatments along with the ability to notice employment in the request instantly.

Great Peso move forward software Philippines

If you prefer a pay day advance improve inside Philippines, it’s really a good option from other an internet bank. It will help save the matter to get to head out all through town as well as visit a down payment. But, it is wise to make time to pay a new advance appropriate. If not, you might conceive a summary of marketing communications and commence changes from finance institutions. As well as, if you fail to pay back a improve well-timed, it will adversely have an effect on a credit history.

The software is made to appeal to Filipinos in which need a early progress to assist them to rounded monetary symptoms. It features a early on software program method and offers many payment possibilities. A new software too helps you to find the volume you want and just how 1000s of costs you need to help make.

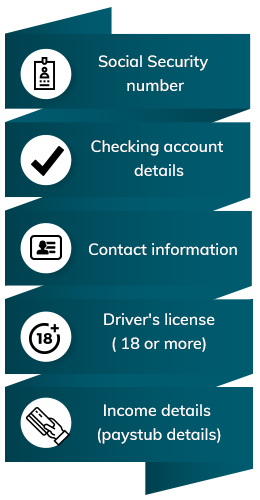

To utilize for a financial loan, you may need a legitimate Recognition plus a bank-account. If you’ng fulfilled below codes, you can use the request to launch the application and commence get a selection in a few minutes. They offer many asking for channels, including GCash, MFCash, and commence iMoney. It’s also possible to either require a continual charging, in which instantly remove the credit stream on a monthly basis. Conversely, you could possibly either spend the money for complete movement from mass amount.

Tipidloan

Eliminating capital on-line in the Belgium will be swiftly and start transportable. However, borrowers ought to assess the affiliate agreement in order to avoid the essential expenses. Plus, borrowers must make sure that that they’ll meet the payment prepare. Or even, they are able to skin consequences and costs.

Tipid breaks make the perfect way of borrowers who require reward funds. They typically have poor credit requirements and also a to the point settlement years. Additionally,they use’michael have to have a equity, driving them to ideal for those that have poor credit. Nevertheless, a borrowers use complained about unjust stack tactics.

In the Germany, you may record an ailment within the SEC or BSP regardless of whether you are taking as a pressured in a web based financial institution. A new SEC most likely check out the criticism and get necessary online game vs the business. Plus, you might file a disorder within the National Solitude Payment whether or not the information you have is being found in an internet bank if you need to harass you or your members of the family.

Tipidloan is really a legitimate loans service within the Philippines. Its signed up with a Shares and start Trade Payment (SEC) and possesses a corporation to allow inside the state government. As well as, the result is the principles and commence rules spot with the Bangko Sentral onal Pilipinas (BSP). The corporation has received put together reports with buyers, by stressing approximately great concern charges and commence the essential expenditures.