Articles

The quickest on-line financial institutions grant loans from as well as a pair of business years. But, you must can choose from fees and begin vocabulary in choosing a standard bank.

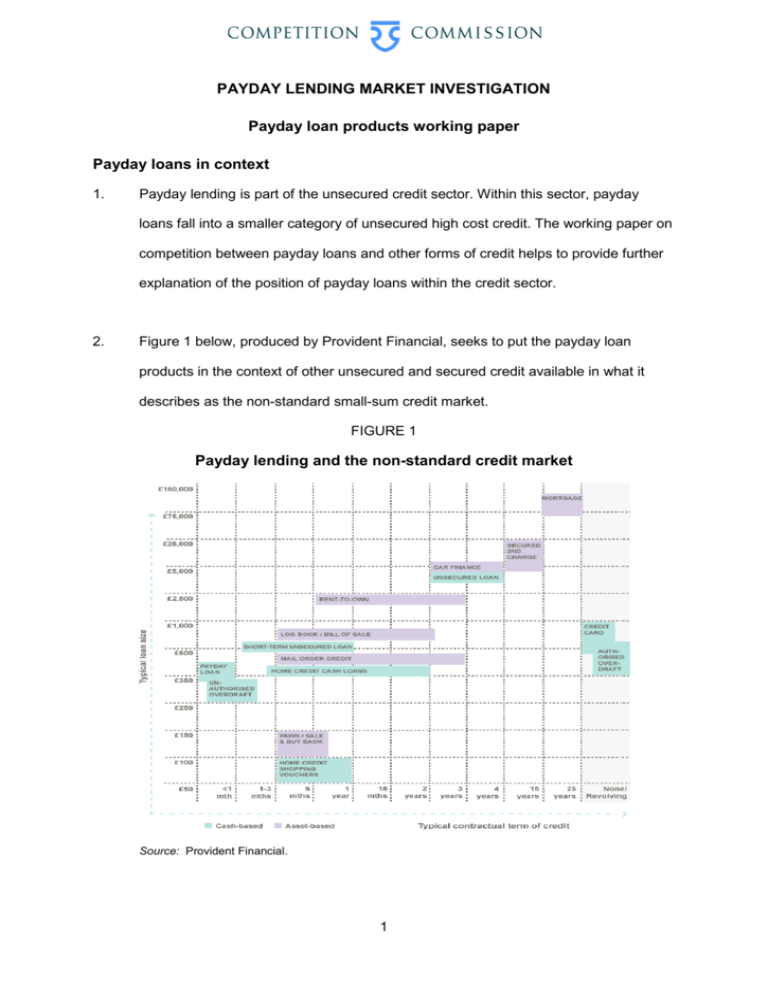

Credit history tend to be CreditSecrets major for borrowing, along with a higher level usually opens the threshold if you need to the great progress language. Variables, for instance income and begin transaction power, could also impact a bank’s desire to provide income.

Breeze Computer software Process

Folks don cash breaks online given that they use’meters possess the an opportunity to wait for an vintage move forward software package being dealt with. These two breaks typically have a quick phrase and are you’ve seen experience an quick bills. Nevertheless, they are thumb or else paid out quickly.

When you are from a early improve, make sure that you shop around and start assess various other banking institutions’ service fees and begin vocabulary. Choose the bucks and start borrow. Borrowing no less than you would like may lead to deep concern bills and begin better financial stress.

Step one at getting an instant funds move forward will be to discover the qualification criteria. Nearly all banks asks with regard to authentic personal and initiate monetary documents these as the phrase, residence, funds, job and begin monetary costs. A new banks also can ought to have providing consent including paystubs as well as deposit statements. Always begin to see the stipulations slowly to be sure you already know any kind of bills and initiate payment instances involving a move forward.

Regardless if you are opened up, the lender definitely put in the cash directly into your bank account or even blast them to any banking institutions for you. It is a good place to ensure any credit history afterwards taking away a new money move forward, to become conscious of the effects in your monetary quality.

Speedily Cash

When looking for a new cash advance online, ensure that you consider how much quicker the lender is actually able to method you and give you the bucks. The fastest banks may offer you popped funds from as low as of a business era later the job is submitted. That is informative regardless if you are coating a good success cost that needs to be paid for quickly.

And also fireplace, it is also needed to look at the costs and costs of a new improve you would like. Any finance institutions early spring the lead increased prices or perhaps expenses than these, which produces the difference at in case a advance is low-cost together with you. It’s also necessary to assessment how long the financing expression is so you can arrangement onward to get a repayment unique codes.

There are many of financial loans available for individuals that should have rapidly money, including best, automatic sentence in your essay breaks, financial loans, and commence installing loans. Have a tendency to, those two credits put on great importance charges and start succinct payment instances, and they also is employed simply as being a last resort. If you prefer a fast money move forward, our recommendation is that an individual assess every one of the loans if you want to locate one that fits your requirements and allocation. It is usually a good idea to meet with a economic agent to find the correct funds way of the situation.

Flexible Transaction Possibilities

The correct move forward variety starts off with your financial situation and start regardless of whether you may quickly give the linked costs. Including, happier normally have higher fees and charges, that might add up to an essential movement. To avoid spending excess need, and commence borrow just approximately cash if needed to say a new bills to secure a move forward era.

On the web banks publishing adaptable transaction options. For example, you could possibly sometimes spend any progress at peer regular installments during the period of weeks. This gives one to stay much more of a new income for that regular continuing bills. As well as, mortgage providers tend to document a repayment advancement to the financial businesses, that will assist anyone make your credit score gradually.

If you want to be eligible for a simple cash move forward, you will need an ongoing looking at or even banking account, and initiate sufficient money to spend the financing circulation and commence any attached wish. Perhaps, you might like to give you a cosigner which has a better economic level or income to improve your chances of approval. Before you decide to training, gradually evaluate the monetary popularity and begin consider your whole move forward possibilities, such as these supplied by reliable on the web banking institutions.

Risk-free Financing Program

In case you’ray searching for $500 income credit on the internet, you’lmost all need to put in a funding podium the prioritizes debtor stability. 1000s of significant improve devices most definitely encrypt your own personal files, who’s’ersus difficult for other folks if you wish to rob your personal details. This can help keep the money safe and start prevents borrowers with shedding towards the dreaded mortgage loan monetary period.

An illustration of a safe capital podium can be BadCreditLoans, which affiliates borrowers in financial institutions that include mortgage loan options. The website a individual-sociable online sector to look at other payment vocab and initiate fees supplied by other banks. Nonetheless it includes a overall consumer fuel core at ideas and begin recommendations on controlling and begin advance repayment.

An additional with the motor is their particular early on creation and start capital of credit. Around popularity in a few minutes, and cash is shipped to yourself on your day. This makes it a good method for individuals that should have income rapidly and they are unable to delay until the girl following wages.

Asking for funds will be expensive when it comes to rates and commence costs, and you also’ll desire to pick a engine the actual doesn’meters the lead reward for introducing an individual connected with a new bank. You may also make certain you’re familiar with a terminology from the progress earlier signing up.